Turned Out to Be a White Christmas After All

January 19, 2022

Authors: Avanti Bakane, Thomas Blatchley, and Mary Curtin

In a late December holiday present to furnishers everywhere, the Eleventh Circuit struck another blow to Plaintiffs’ “dispute/non-dispute” scheme wherein Plaintiffs seek to hold furnishers liable for failing to investigate a dispute, when in fact the furnishers have been notified by one or more credit reporting agencies that the account was no longer being disputed. In White v. Equifax Info. Serv’s LLC , Case No. 21-11840 (11th Cir. Dec. 23, 2021), the Court affirmed what Fair Credit Reporting Act (FCRA) reasonableness actually requires of furnishers faced with these tenuous claims.

The underlying facts are straightforward and recognizable to those in the industry. When Plaintiff Veda White observed in credit reports from two CRAs a notation that she disputed her Wells Fargo tradeline, she sent a letter to those CRAs saying she no longer disputed the tradeline. The CRAs then forwarded that letter to Wells Fargo asking that Wells Fargo investigate the dispute.

Because Wells Fargo had not received any direct contact from Plaintiff saying she no longer disputed the tradeline, Wells Fargo’s records indicated that the tradeline was still in dispute. Wells Fargo reported as much to the CRAs, who left the dispute notation on Plaintiff’s reports. After seeing that the notation remained, Plaintiff filed suit against Wells Fargo in federal court for the Northern District of Georgia alleging that it violated the FCRA by failing to investigate her dispute.

Here, two key facts made the difference for the panel: (1) the confusing nature of Plaintiff’s “non-dispute” letter to the CRAs and (2) the fact that the letter was sent to the CRAs and not to the furnisher, Wells Fargo.

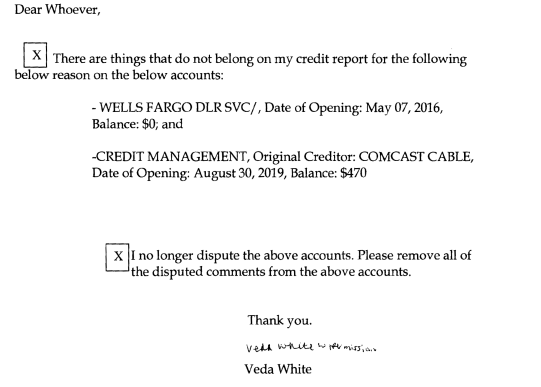

Plaintiff’s letter to the CRAs, which is contained in the body of the Eleventh Circuit’s opinion, stated:

The panel rejected Plaintiff’s tortured arguments, which relied on the unreasonable assumption that the above correspondence should have informed the furnisher that the dispute was resolved and no longer disputed by Plaintiff. In a terse opinion of just eight pages, the Eleventh Circuit neatly dismantled Plaintiff’s theory, explaining:

What Ms. White wants Wells Fargo to do—either (1) to intuit that she no longer disputed the tradeline from her report to the CRAs or (2) to reach out to her directly to clarify and confirm that she no longer wished to dispute the tradeline—goes beyond what FCRA reasonableness requires.

However, furnishers and defense counsel alike should note that the Court took care to observe that perhaps there may be other, better practices available to furnishers, such as contacting the consumer to determine whether she was, as an initial matter, attempting to resolve the underlying dispute with that furnisher through the CRAs as an intermediary. Of note, the Court unequivocally held that such “better” practices are not what FCRA reasonableness requires. This direct and unwavering statement of the law from the Eleventh Circuit should stem the tide of FCRA “non-dispute” claims which have flooded federal dockets for the past few years.

Next up – we watch (and defend) as the ever-persistent plaintiffs’ bar tries to skirt White and similar rulings across the circuits by abandoning their FCRA theory and testing their “non-dispute” claims under the Fair Debt Collections Practices Act (FDCPA) instead.

A complete copy of the White v. Equifax Info. Serv’s, LLC opinion can be accessed via the Eleventh Circuit at this link.